Tax Relief Act 2024 Philippines Update – As the Philippine economy is gradually recovering from the effects of the Covid-19 pandemic, the Revenue Memorandum Circular (RMC) 7-2024, issued on Jan. 11, 20 . Paying amilyar, or real property tax, that is due on the first day of January each year, is a task performed by Filipino homeowners as a matter of civic duty. Amilyar is imposed on property owners by .

Tax Relief Act 2024 Philippines Update

Source : www.wolterskluwer.com

How to Report Income and Tax Information for U.S. Territory

Source : www.collegeaidservices.net

The Bluebook: A Summary of Key Tax Topics for 2024 | FORVIS

Source : www.forvis.com

Paul Masse Chevrolet in E PROVIDENCE | Serving Pawtucket, RI and

Source : www.paulmasseeastprovidence.com

Tax Deduction Definition: Standard or Itemized?

Source : www.investopedia.com

Baker Tilly | Advisory, Tax and Assurance Baker Tilly

Source : www.bakertilly.com

2024 outlook: China property market turn requires new growth model

Source : asia.nikkei.com

2024 Ford Ranger® Truck | Pricing, Photos, Specs & More | Ford.com

Source : www.ford.com

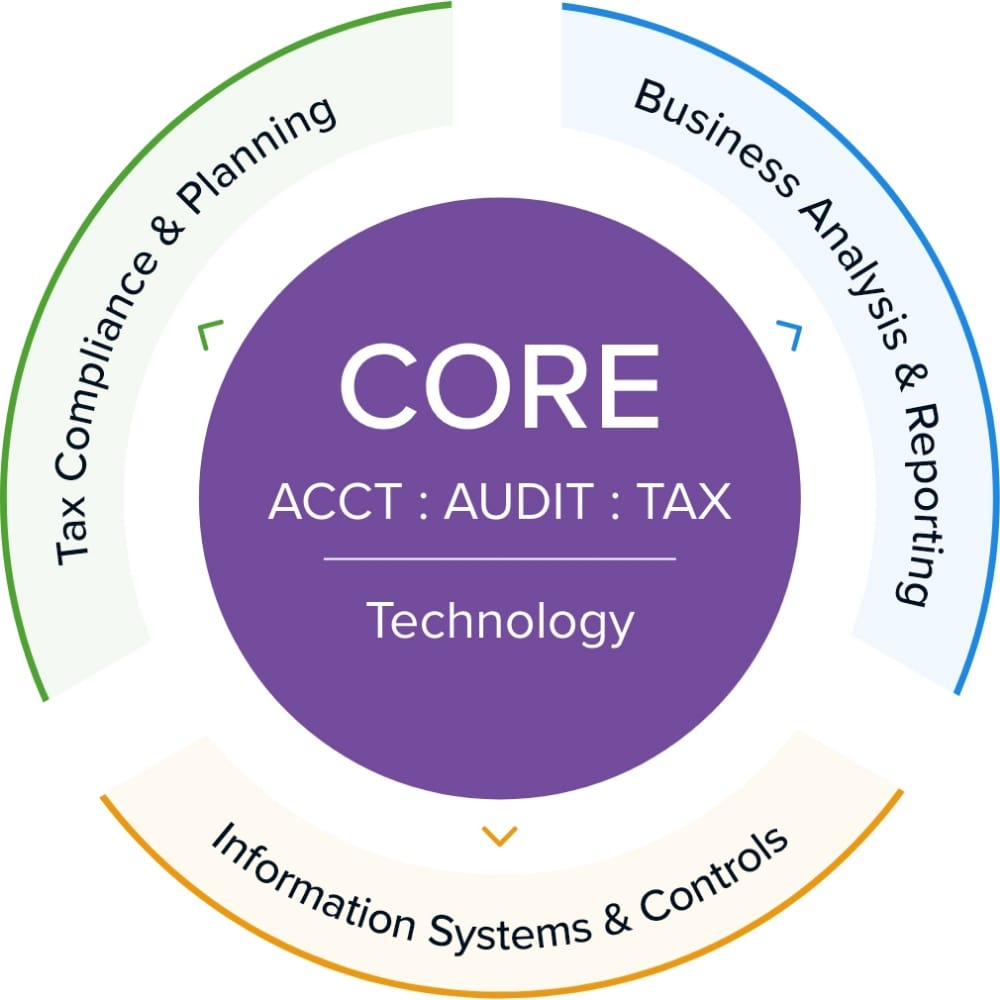

2024 CPA Exam Changes: CPA Evolution

Source : accounting.uworld.com

IRS Launches Free File for 2024 Tax Season With Major Eligibility

Source : www.nasdaq.com

Tax Relief Act 2024 Philippines Update The Tax Relief for American Families and Workers Act of 2024 : Income Tax 2023-2024: People filing income tax returns option that can help you save tax considerably. Tax exemption from HRA can be claimed under Section 10 (13A) of the Income Tax Act. Total . Bureau of Internal Revenue Commissioner Romeo D. Lumagui Jr has issued Revenue Regulations No. 1-2024 which increased, for Value-Added Tax (VAT) exemption purposes, the selling price threshold of the .

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)